The VMP Pro Prop Firms EA is specifically crafted to meet the demands of traders working with proprietary trading firms. These firms allocate capital to traders under structured guidelines that include defined strategies, risk limits, and profit objectives. This EA is designed to operate effectively within those parameters, utilizing advanced algorithms to analyze market conditions and execute trades based on carefully set criteria.

Key Features

Innovative Trading Strategy – The VMP Pro EA is built on a price action and trend-based approach, ensuring precise market analysis and trade execution.

Multi-Pair Compatibility – It operates simultaneously on five major currency pairs, maximizing trading opportunities across different market conditions.

Low Drawdown – With a drawdown of under 4%, the EA prioritizes stability and controlled risk.

Strict Risk Management – It limits exposure to just 3% of the total account balance, reducing the likelihood of significant losses.

Optimized for Key Market Sessions – Designed to perform efficiently during the London and New York trading hours for enhanced profitability.

Comprehensive Market Analysis – The EA evaluates multiple market factors to make informed trading decisions.

No Martingale or Hedging – It avoids high-risk strategies, focusing on sustainable and calculated trading.

User-Friendly Design – Simple to set up and operate, making it accessible to traders of all experience levels.

Flexible Capital Requirements – Works with account sizes ranging from $20K to $500K, catering to both individual and institutional traders.

Recommendations

- Compatible Trading Platform – Designed for seamless integration with MetaTrader 4 (MT4).

- Deposit Requirements – Suitable for accounts ranging from a minimum of $10K to a maximum of $500K.

- Supported Timeframes – Optimized for M1, M5, M15, and M30 charts to adapt to different trading strategies.

- Tradable Currency Pairs – Works efficiently with EURUSD, GBPUSD, AUDUSD, USDCAD, and USDCHF.

- Product Type – NoDLL / Fixed, ensuring a stable and secure trading environment.

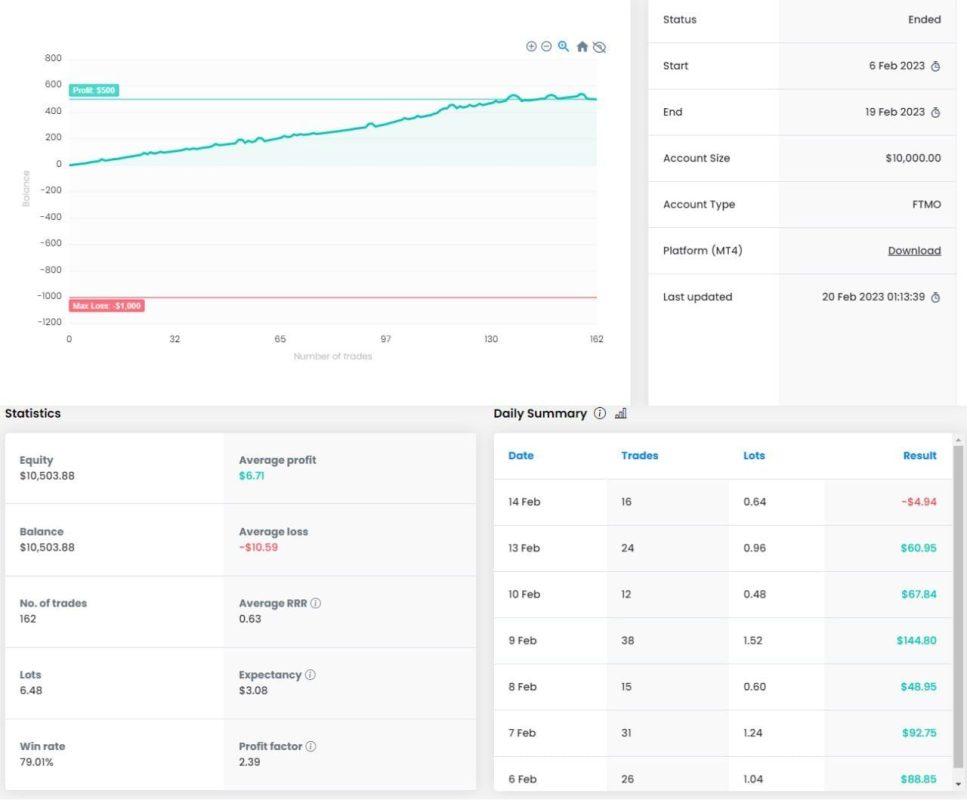

BackTest Reports

Reasons to use

- Tailored for Proprietary Trading Firms – Designed to meet the structured guidelines of prop firms, ensuring compliance with risk management and trading rules.

- Advanced Price Action & Trend Strategy – Uses a refined approach to market analysis, increasing accuracy in trade execution.

- Multi-Pair Trading Capability – Operates across EURUSD, GBPUSD, AUDUSD, USDCAD, and USDCHF, maximizing trading opportunities.

- Low Risk & Drawdown – Maintains a 3% risk per trade and keeps drawdown below 4%, making it a safe choice for long-term trading.

- No High-Risk Strategies – Does not use martingale or hedging, ensuring a disciplined approach to trading.

- Works During Major Market Sessions – Optimized for both London and New York trading hours, capitalizing on high liquidity periods.

- Multiple Timeframe Compatibility – Supports M1, M5, M15, and M30 timeframes, allowing for flexible trading strategies.

- User-Friendly & Fully Automated – It requires no manual intervention, making it ideal for traders of all experience levels.

- Wide Account Size Support – Suitable for account balances from $10K to $500K, accommodating both individual and institutional traders.

- Reliable & Stable Trading System – A NoDLL / Fixed product type ensures smooth and secure operation on MetaTrader 4 (MT4).

Pros and Cons of VMP Pro Prop Firms EA

✅ Pros:

- Designed for Prop Firms – Specifically built to meet the trading and risk management requirements of proprietary trading firms.

- Advanced Strategy – Utilizes a price action and trend-based approach for precise trade execution.

- Multi-Pair Trading – Supports EURUSD, GBPUSD, AUDUSD, USDCAD, and USDCHF, increasing diversification.

- Low Drawdown – Maintains a drawdown below 4%, ensuring account stability.

- Strict Risk Management – Limits exposure to 3% of total balance, reducing potential losses.

- No Martingale or Hedging – This avoids high-risk strategies, making it a safer option for long-term trading.

- Optimized for Major Sessions – Works best during London and New York market hours, capitalizing on high liquidity periods.

- Multiple Timeframe Compatibility – Supports M1, M5, M15, and M30 for flexible trading strategies.

- Automated and Easy to Use – It requires no prior experience, making it accessible for all traders.

- Wide Account Size Support – Works with balances ranging from $10K to $500K, catering to different trading capital levels.

❌ Cons:

- High Minimum Deposit – Requires at least $10K, which may not be accessible for small retail traders.

- Limited Platform Support – Only available on MetaTrader 4 (MT4), restricting users who prefer MT5 or other platforms.

- Fixed Product Type – Being NoDLL / Fixed, customization options may be limited for advanced traders.

- Market Session Dependency – Performs best during London and New York sessions, which might not align with all traders’ schedules.

- Requires a Reliable Broker – Performance can be affected by broker execution speeds, spreads, and trading conditions.

Reviews

Clear filtersThere are no reviews yet.