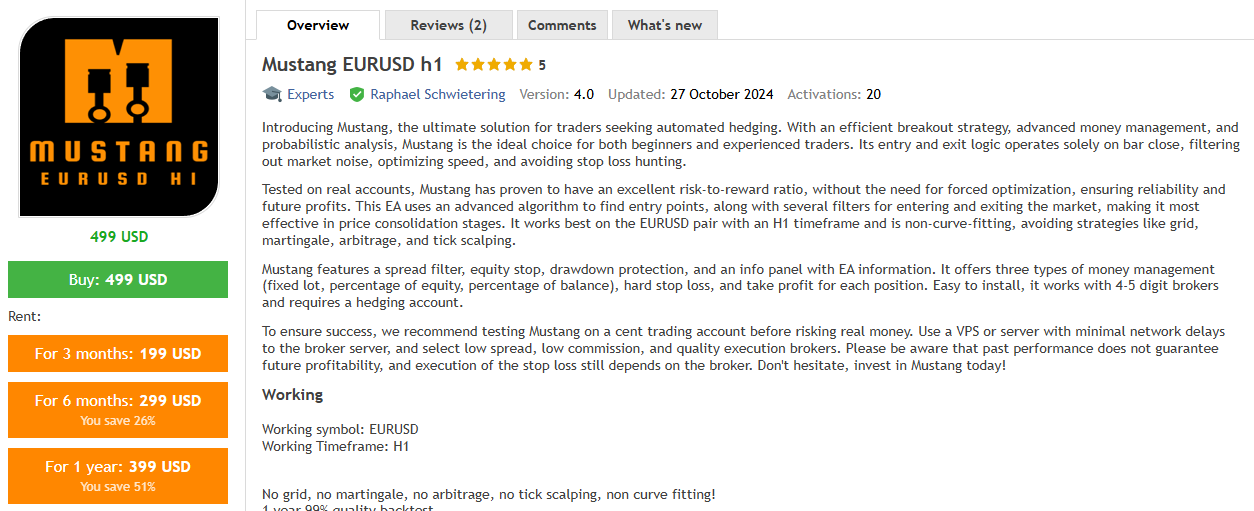

Introducing Mustang – a powerful automated trading tool designed for EURUSD on the H1 timeframe. It uses a smart breakout strategy, advanced money management, and filters to trade only when conditions are right. Mustang avoids risky methods like martingale, grid, or arbitrage and relies on bar-close logic for clean, accurate entries.

Built for hedging accounts, it includes spread filters, drawdown protection, an equity stop, and a clear info panel. You can choose from three money management modes: fixed lot, equity %, or balance %. Each trade uses a hard stop loss and take profit for safety.

Mustang runs smoothly on 4-5 digit brokers, is easy to install, and works best with low spread and fast execution brokers. For best results, start with a cent account and use a VPS for low latency. Reliable and well-tested, Mustang is ready for real trading—no optimization needed.

Vendor Website – Link

Key Features

Compatible with 4-5 digit brokers

Spread filter included

Equity stop feature

Drawdown protection

Information panel displaying EA details

Three money management options (Fixed Lot, Percentage of Equity, and Percentage of Balance)

Advanced algorithm for market entry and exit

Hard stop loss and take profit for each trade

Simple installation process

Extra Features

🔹Flexible Money Management Options – Choose from Fixed Lot, Equity Percentage, or Balance Percentage modes, making it adaptable to different trading approaches and account sizes.

🔹Built-In Spread Filter – Prevents trades from opening during periods of wide spreads, helping maintain stable and reliable performance.

🔹Supports 4 and 5 Digit Brokers – Designed to work smoothly with all common MT4 brokers, whether they use 4-digit or 5-digit pricing.

🔹Optimized for Hedging Accounts – Specifically built for hedging environments, giving traders more freedom without being limited by FIFO rules.

🔹Reliable Long-Term Strategy – Steers clear of risky tactics like martingale, grid trading, arbitrage, or tick scalping, focusing instead on a solid, well-tested trading approach.

✅ Key Highlights of Mustang EURUSD H1 EA

- Specially designed for EURUSD on the H1 timeframe, delivering focused and accurate trade setups.

- Avoids high-risk tactics like martingale, grid trading, arbitrage, and tick scalping for a more stable trading approach.

- Uses a bar-close entry and exit strategy, analyzing fully formed candles for smarter trade decisions.

- Features a 1-year backtest with 99% modeling quality, proving its consistency and reliability under real market conditions.

- No optimization is required — already tuned for live trading and current market dynamics.

- Ideal for traders looking for a low-risk, high-precision Forex robot that fits seamlessly into the MetaTrader 4 (MT4) environment.

- Does not rely on curve-fitting, ensuring genuine performance over time rather than overfitting to past data.

Recommendations

| Specifications | Details |

| Platform | MetaTrader 4 (MT4) |

| Supported Timeframe | H1 |

| Trading Pair | EURUSD |

| Minimum / Suggested Deposit | $500 |

| Leverage Requirement | Works with any leverage |

| Installation Files | Included |

| Software Type | NoDLL / Fixed version |

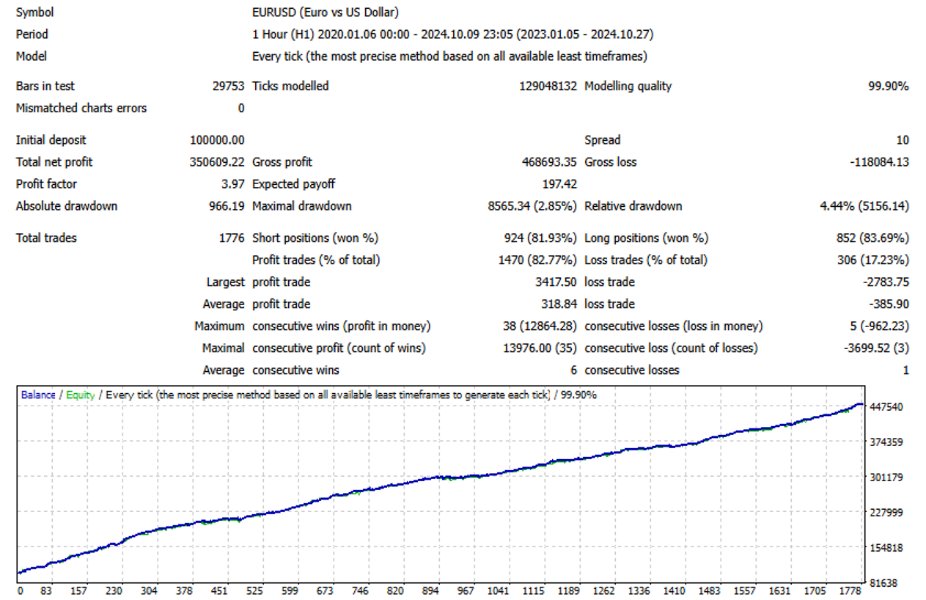

Mustang EURUSD H1 – Backtest Highlights

- 📅 Test Period: From January 6, 2020, to October 27, 2024 – covering various market conditions.

- 💰 Initial Deposit: started with a $100,000 trading account.

- 📈 Total Net Profit: Earned $350,600 in gains, showing strong profitability over time.

- 🎯 Win Rate: Achieved a high success rate of 82.77%, indicating excellent trade accuracy.

- 🔒 Max Drawdown: Kept losses minimal, with only a 2.85% drawdown, showing solid risk control.

- ⚙️ Optimized for EURUSD H1: Tailored for the EURUSD pair on the H1 timeframe, providing reliable performance.

- 📊 Ideal for Consistent Growth: A well-balanced MT4 EA suitable for traders seeking steady returns with low risk.

Reasons to use

If you’re serious about trading the EURUSD pair with consistency and precision, the Mustang EURUSD H1 EA offers a solid, practical solution tailored for traders using the MetaTrader 4 platform. Here’s why it’s a smart choice for both experienced traders and those just getting started in automated Forex trading:

- Optimized for a Specific Strategy

Mustang EA is specifically designed to operate on the EURUSD currency pair and works best on the H1 timeframe. This focused strategy avoids the pitfalls of overly broad or unstable systems and ensures more accurate trade decisions.

- Simple Setup with Ready-to-Use Files

Installation is straightforward, with all necessary setup files provided. No complex configurations or external libraries like DLLs are needed, making it ideal for users who prefer a plug-and-play trading solution.

- Safe and Adaptive Risk Control

The EA comes with built-in risk management options, allowing you to choose between Fixed Lot, Percentage of Equity, or Percentage of Balance. This gives traders flexibility depending on account size and risk preference—crucial for consistent performance.

- Compatible with Most Brokers

Whether your broker uses 4-digit or 5-digit pricing, Mustang EA runs without issues. It’s also designed for hedging accounts, giving you more freedom with trade entries and exits without worrying about FIFO limitations.

- Avoids High-Risk Methods

Unlike many expert advisors, Mustang doesn’t rely on high-risk tactics like martingale, grid trading, arbitrage, or tick scalping. This makes it a more sustainable and reliable option for long-term traders looking for steady returns.

- Designed for Stability

With features like an equity stop, drawdown protection, and a spread filter, the EA protects your account from volatile market conditions and ensures trades only open under favorable scenarios.

- Hard Stop Loss and Take Profit

Every trade is equipped with a defined stop loss and take profit, giving you better control over risk exposure and helping to eliminate emotional decision-making.

- Tailored for $500+ Accounts

Though the system can run on various account sizes, a minimum deposit of $500 is recommended for optimal performance. This makes it accessible for small to medium-sized accounts while still delivering professional-level results.

✅ Pros and ❌ Cons of Mustang EURUSD H1 EA

✅ Pros

- Purpose-Built for EURUSD on H1 Timeframe

Designed exclusively to trade the EURUSD pair on the 1-hour chart, ensuring the strategy is fine-tuned for optimal performance rather than being spread thin across multiple pairs or timeframes. - Multiple Risk Control Options

Supports three distinct money management modes: Fixed Lot, Equity Percentage, and Balance-Based Lot Size, giving traders the freedom to tailor risk settings according to their trading capital and style. - No-Risky Techniques Involved

Mustang EA doesn’t rely on aggressive systems such as martingale, grid, or arbitrage, which are often associated with high drawdowns and blown accounts. This makes it a safer option for long-term trading. - Works with Most Brokers

Whether your broker uses 4-digit or 5-digit quotes, the EA functions seamlessly. It also supports hedging accounts, making it a great fit for non-FIFO trading environments. - Built-In Account Protection

Includes important safety tools like equity stop, maximum drawdown control, and a spread filter to keep the EA from trading in poor market conditions. - Fixed Stop Loss and Take Profit

Every trade has a clearly defined stop loss and take profit, promoting better risk management and consistent trade outcomes. - Easy to Set Up

Comes with full setup files and a user-friendly installation process. No complicated add-ons or external DLLs are required.

❌ Cons

- Limited to EURUSD Only

While the narrow focus is part of what makes the EA strong, it also means traders interested in trading other pairs will need to run additional systems. - Requires a Minimum Starting Balance

A recommended deposit of $500 might be a hurdle for those with smaller trading accounts, especially beginners who want to start small. - Only Works on Hedging Accounts

This EA is not suitable for netting accounts, which could limit options for traders using brokers with FIFO rules. - No Scalping or High-Frequency Strategy

Traders looking for fast-paced, high-frequency trading may find the strategy too slow or conservative, as it’s built for stable, steady growth.

Reviews

Clear filtersThere are no reviews yet.