ICT UNO EA is a hands-free trading solution, specifically calibrated for Gold (XAUUSD) and multiple currency pairs. Its effectiveness and outcomes have been demonstrated on actual trading accounts, reflecting stable performance and dependable behavior under real-time market scenarios.

Key Features

🔹 Session-Focused Operation – Executes trades only during the Asian (03:00–06:00) and London (06:00–10:30) timeframes, aiming for high-accuracy setups based on SMC (Smart Money Concepts) and ICT methodology.

🔹 Institutional Trading Framework – Applies core UNO and ICT-based strategies to identify liquidity sweeps, structural changes, and institutional trade zones.

🔹 Daily Target & Trade Restriction – Features customizable daily profit goals and a single-entry limit per day, ideal for prop firm challenges and minimizing excessive trades.

🔹 Adaptive Risk Management – Utilizes a flexible exit mechanism that adjusts based on market movement and liquidity behavior, instead of relying on fixed stop loss or take profit markers—similar to how professional traders operate.

Recommendations

- Compatible Platform: Designed for use on MetaTrader 4 (MT4)

- Supported Instruments: Optimized for Gold (XAUUSD) along with various primary currency pairs./ More Gold (XAUUSD) support EAs – click here

- Chart Interval: Functions effectively on any timeframe

- Starting Capital: Minimum recommended balance is $100

- Suggested Leverage Range: Between 1:100 and 1:500

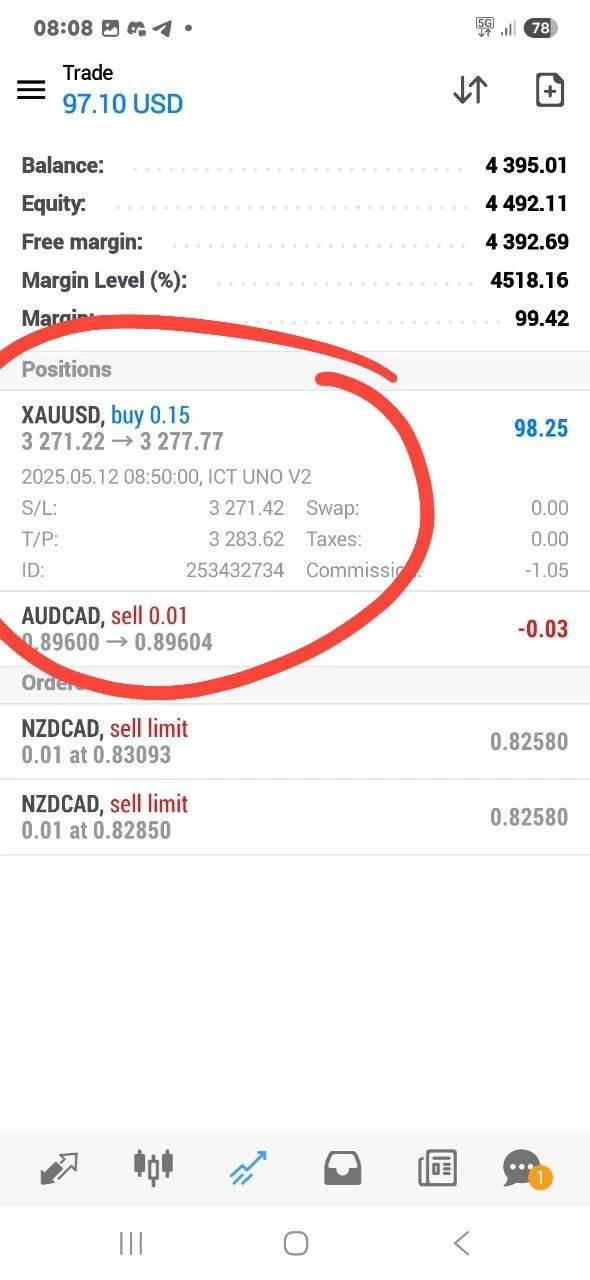

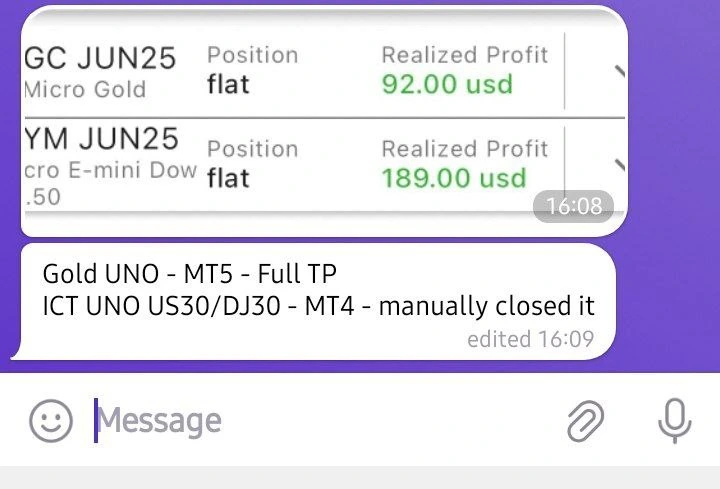

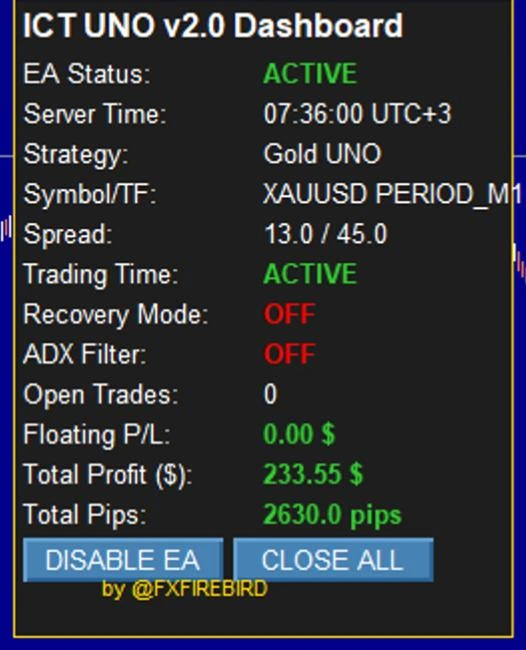

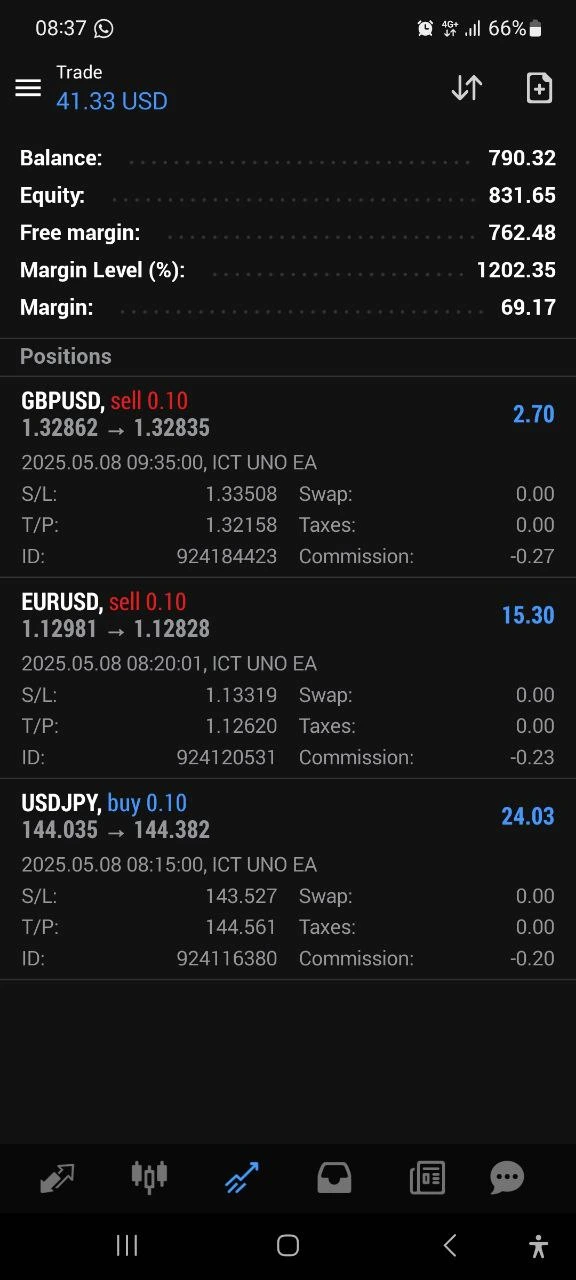

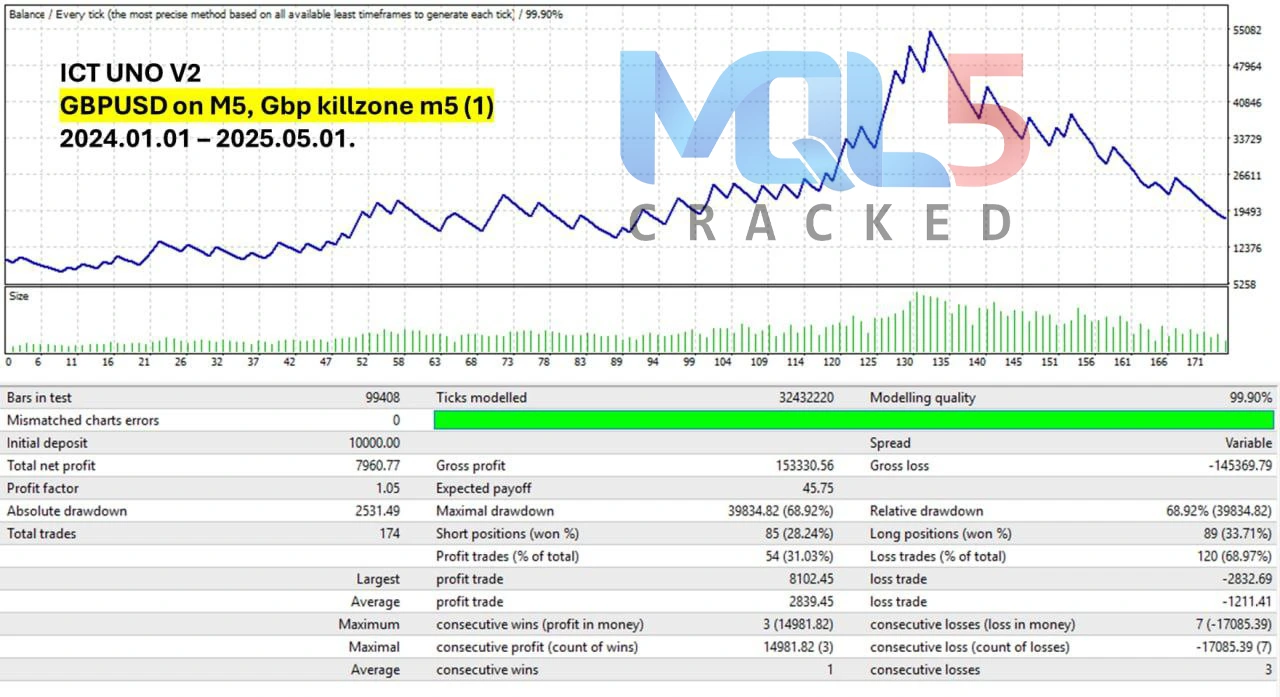

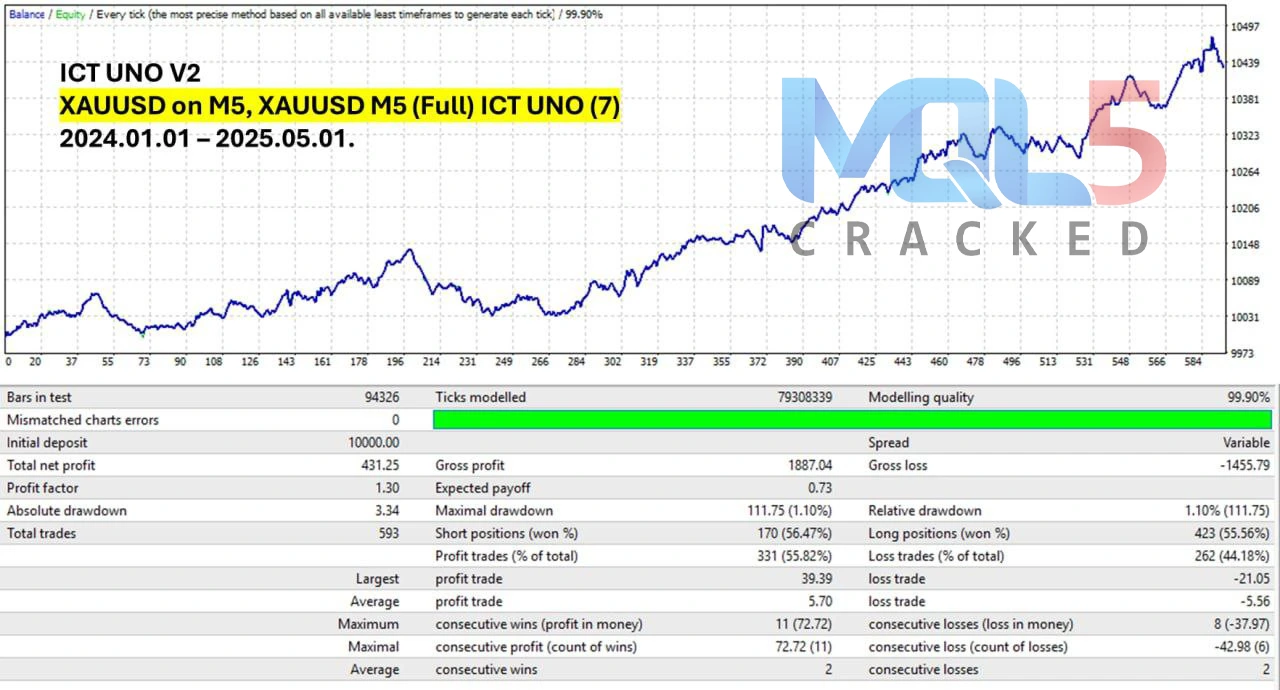

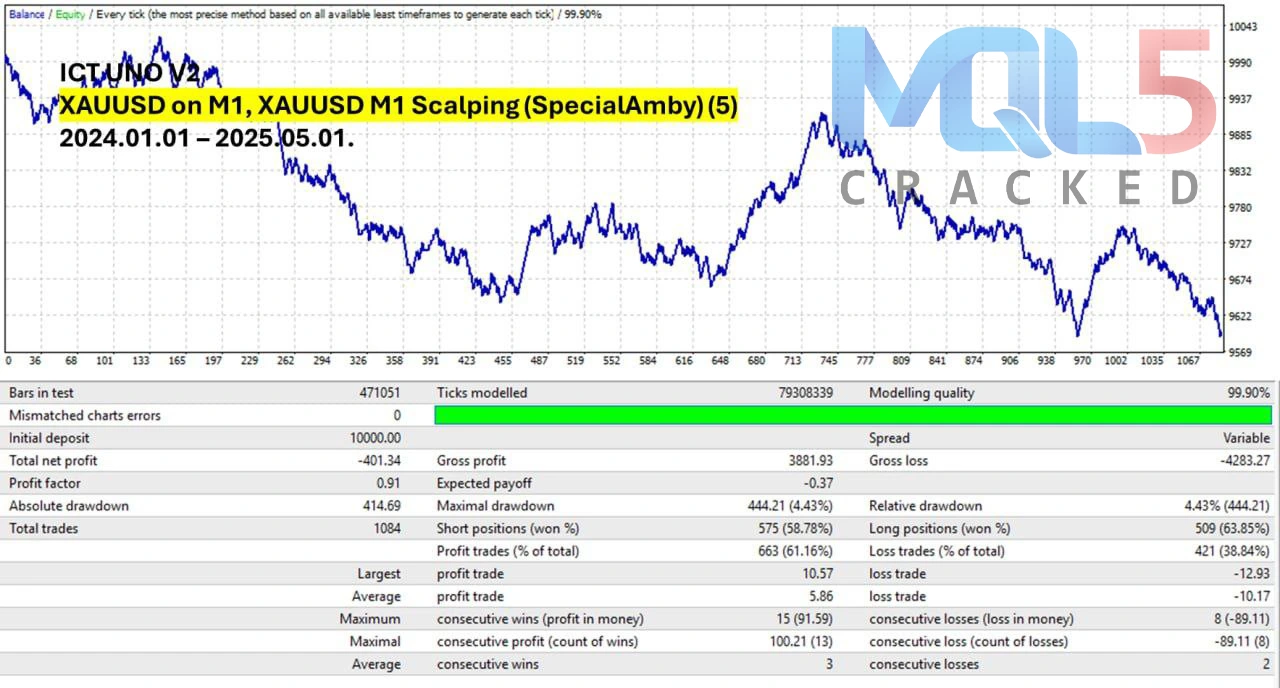

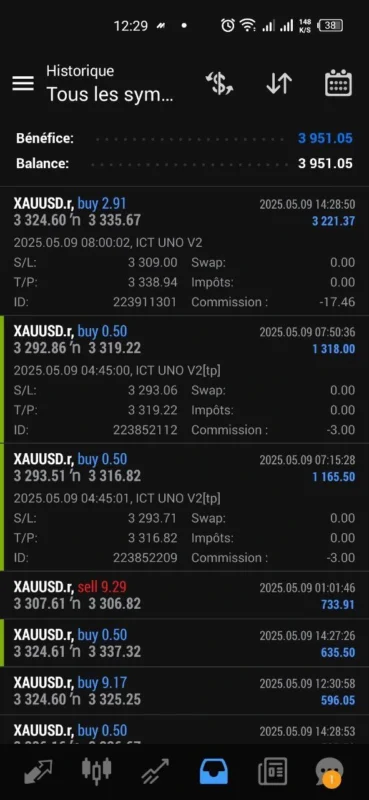

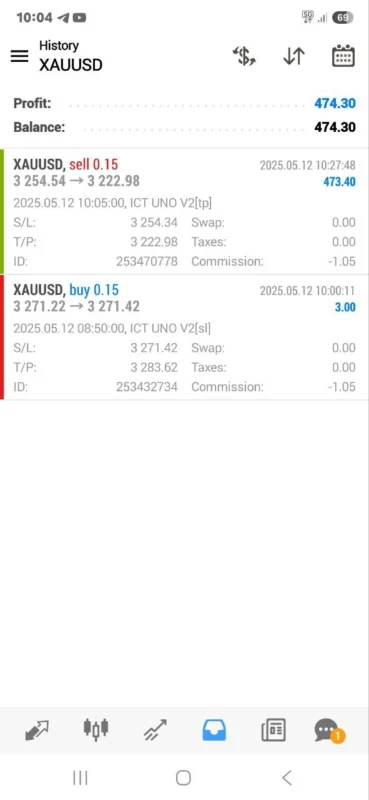

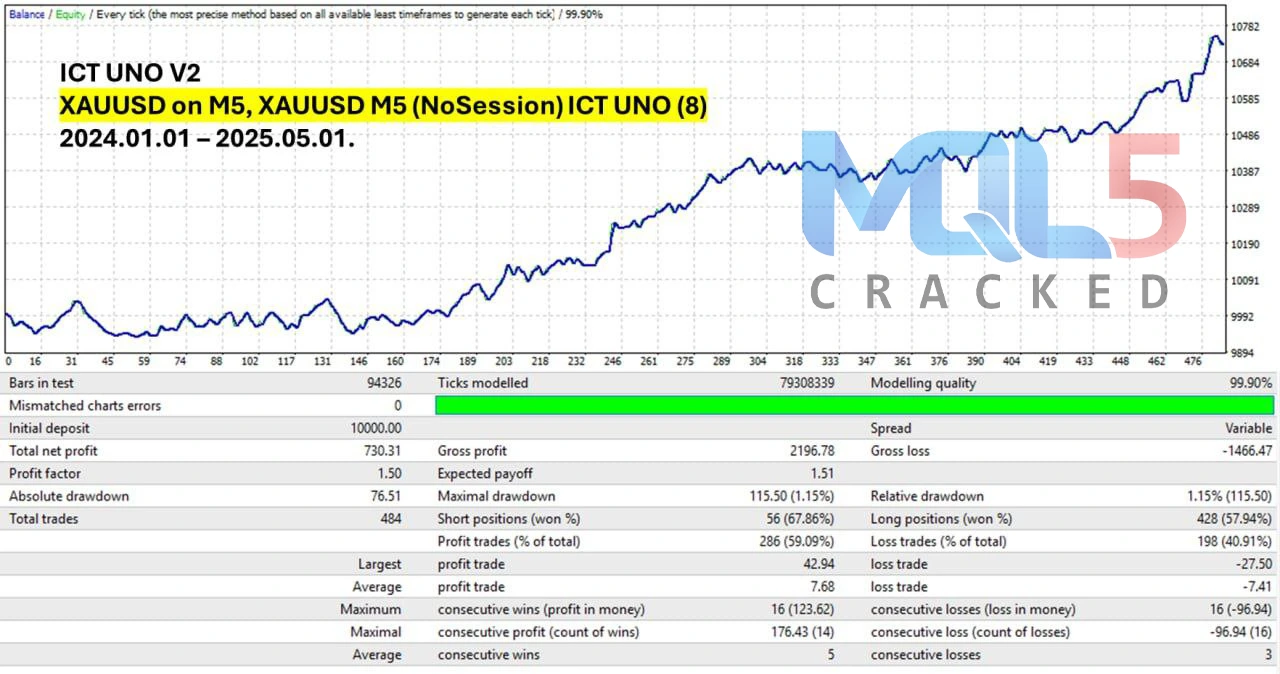

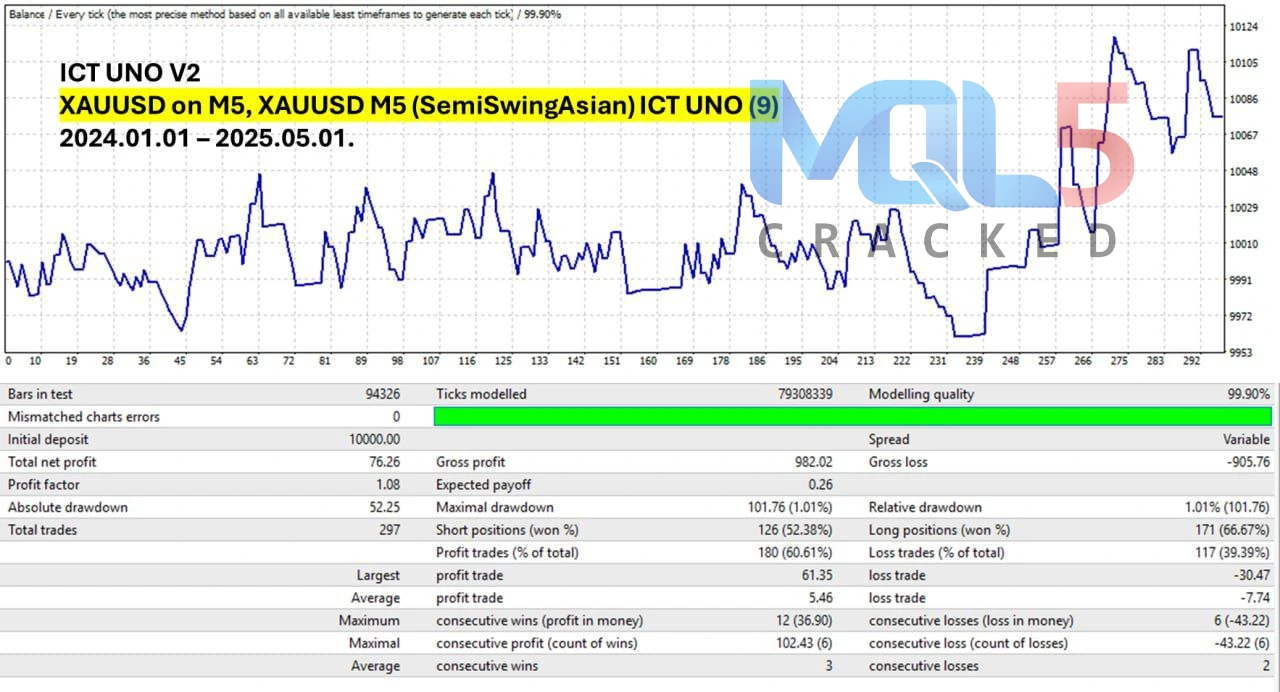

Live Trading Reports

Signal Reports

Reasons to use

Built on Proven Institutional Trading Concepts

ICT UNO EA is based on Inner Circle Trader and Smart Money Concepts, two of the most respected trading methodologies used by professional traders to track institutional moves and liquidity zones. This gives you an edge in identifying high-probability setups that retail traders often miss.

Session-Based Precision

The system operates during specific market sessions—Asian and London hours—when volatility is predictable and liquidity is sufficient. This strategic timing improves trade quality and reduces unnecessary exposure.

Tailored for Gold and Major Pairs

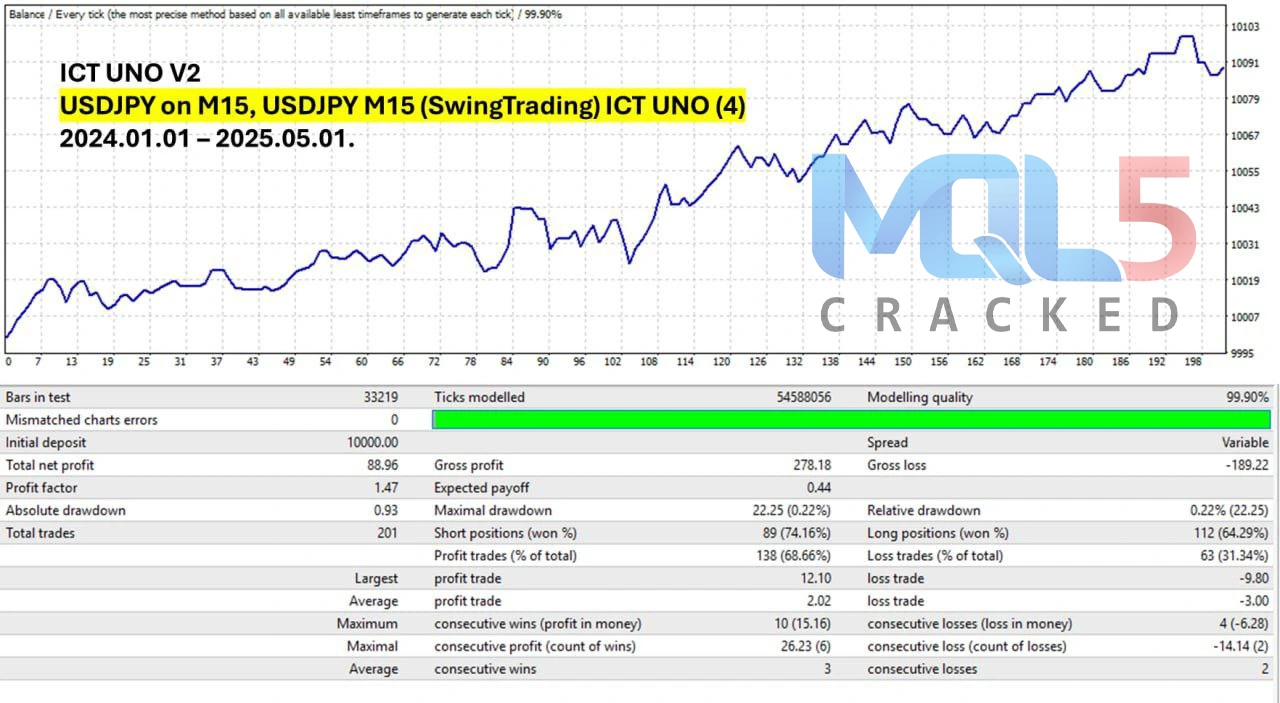

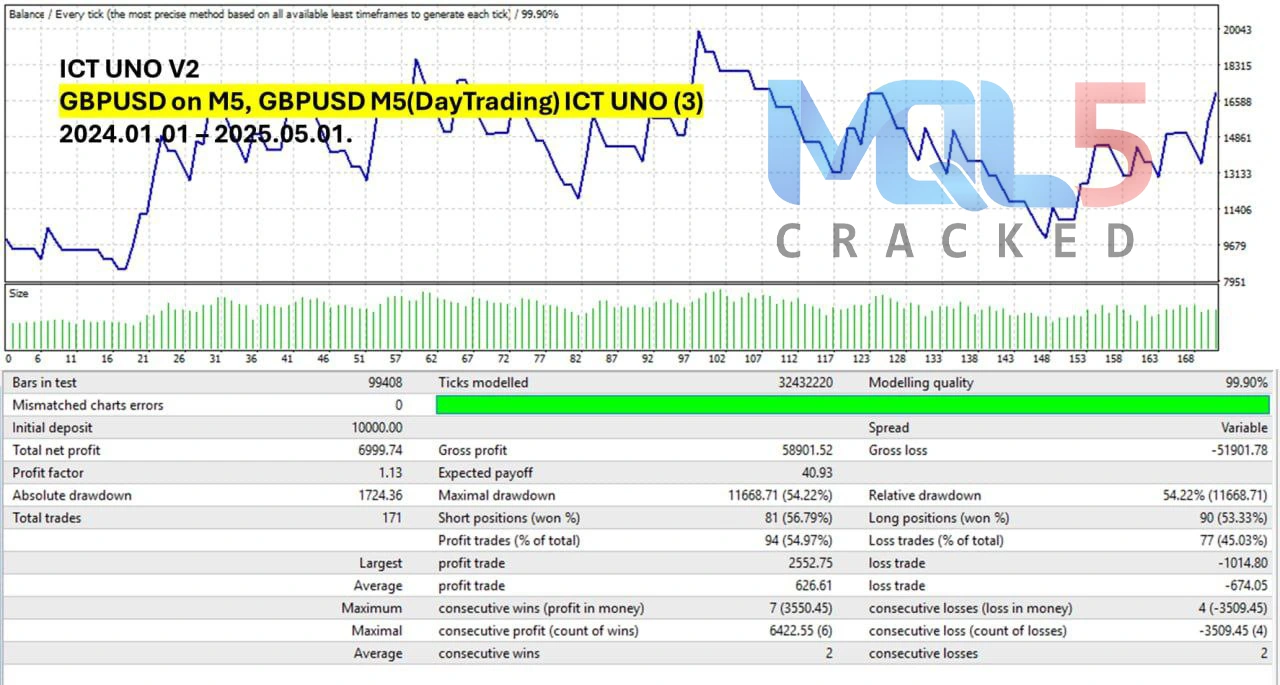

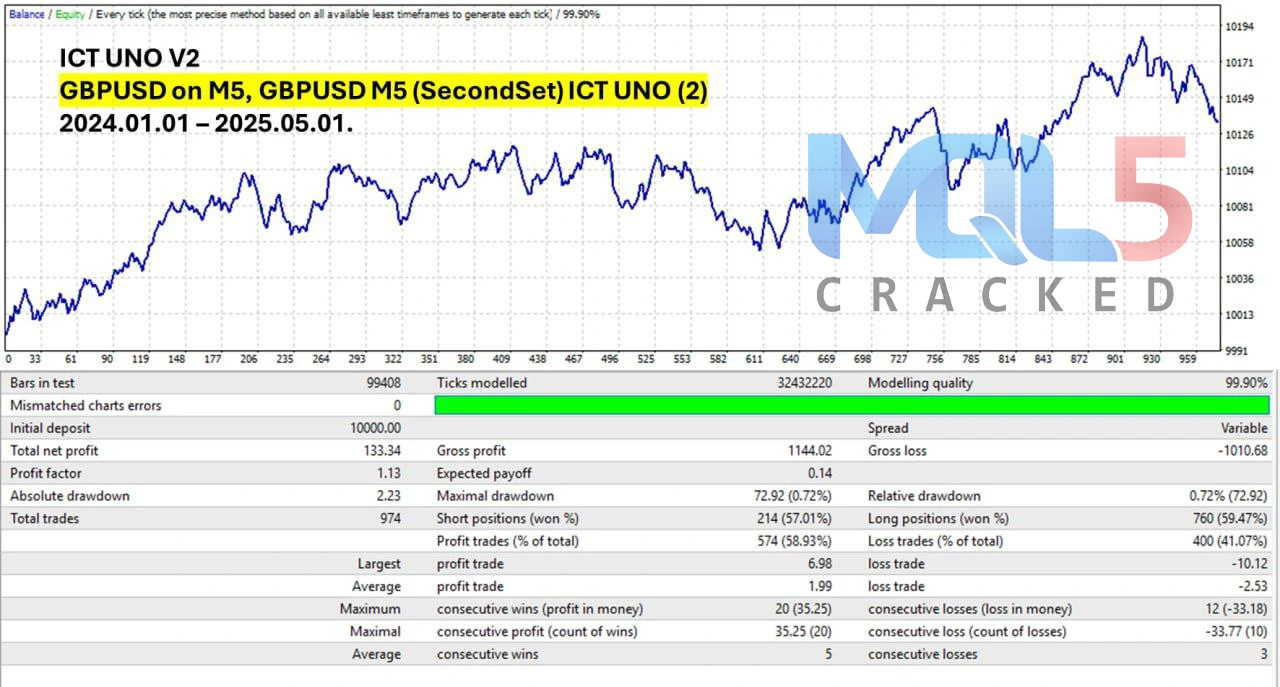

Specially optimized for trading XAUUSD (Gold) and top currency pairs like EURUSD, GBPUSD, and USDJPY, it offers wide coverage while maintaining focused accuracy. This allows for both diversification and targeted performance.

Dynamic Risk and Trade Management

With built-in profit locking, daily trade caps, and adjustable lot sizing, it helps avoid overtrading and drawdown spikes. These features are ideal for those participating in prop firm challenges or managing funded accounts.

Live Results with Verified Data

ICT UNO EA has shown consistent outcomes on real accounts, reinforcing its reliability under live market conditions. This offers confidence to traders looking for proven Forex robots with actual performance history.

Minimal Capital Required

It works effectively with a starting balance as low as $100, making it suitable for small accounts and beginner traders looking to grow steadily without needing large upfront investments.

❓Frequently Asked Questions (FAQ) – ICT UNO EA

- What trading platform is ICT UNO EA compatible with?

ICT UNO EA is specifically designed to operate on the MetaTrader 4 (MT4) platform, one of the most widely used trading terminals in the Forex industry. - Which instruments does the EA trade?

It works best with XAUUSD (Gold) but can also handle other major currency pairs, offering flexibility across different markets. - What trading strategy does it follow?

This EA is based on Smart Money Concepts (SMC) and the ICT (Inner Circle Trader) methodology, which focuses on liquidity grabs, order blocks, and institutional movement patterns. - What sessions does it trade in?

ICT UNO EA executes trades during the Asian (03:00–06:00) and London (06:00–10:30) sessions, targeting periods with consistent volatility and lower risk. - Is the stop loss and take profit visible?

Yes, the system includes a visible SL/TP structure along with a smart dynamic exit strategy that adjusts based on market flow and liquidity. - Is it suitable for prop firm or funded account challenges?

Absolutely. With features like a daily profit lock, trade limit per day, and low drawdown, it’s ideal for meeting prop firm risk requirements. - How much is the minimum deposit required?

The EA can start with as little as $100, though higher balances like $500 or more are recommended for better risk management and performance. - What leverage should I use?

A leverage range of 1:100 to 1:500 is suggested for optimal operation, depending on your broker and account size. - Do I need to monitor the EA manually?

No manual intervention is needed. However, it’s advisable to use a VPS (Virtual Private Server) to ensure 24/7 uninterrupted trading. - Has the EA been tested in live conditions?

Yes, ICT UNO EA has been verified on real trading accounts, confirming its performance and consistency under live market environments.

Reviews

Clear filtersThere are no reviews yet.