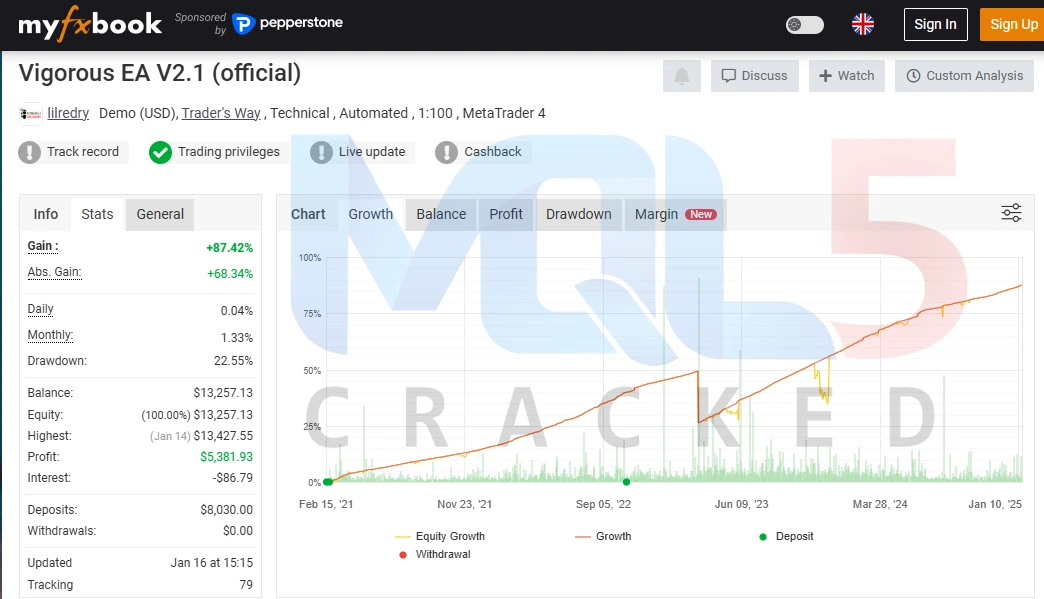

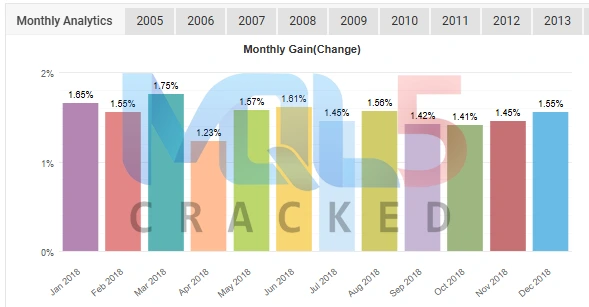

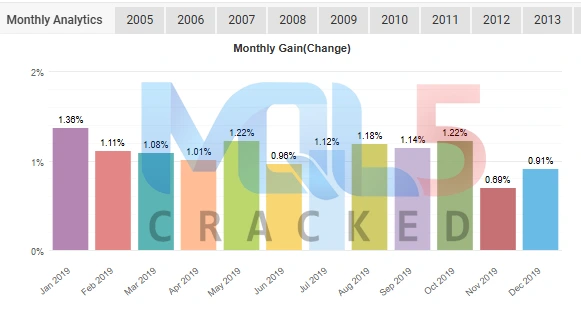

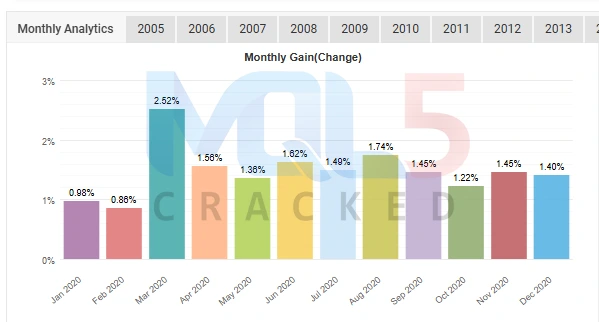

Vigorous EA is a high-performance scalping Expert Advisor tailored for the EURUSD pair on the M1 timeframe in MetaTrader 4, known for its precision trading and solid risk control. It executes 50 to 100 trades weekly, aiming for steady 2–4% monthly gains under default configurations.

Built with 99.90% modeling accuracy and validated by extensive backtesting, it stands out for its long-term stability and resilience. The integrated recovery mechanism and advanced risk management make it a reliable choice for traders seeking low drawdowns and consistent results in fast-paced market conditions.

Vendor Website – Link

Key Features

- Aims for a steady monthly profit of 2–4% using default settings

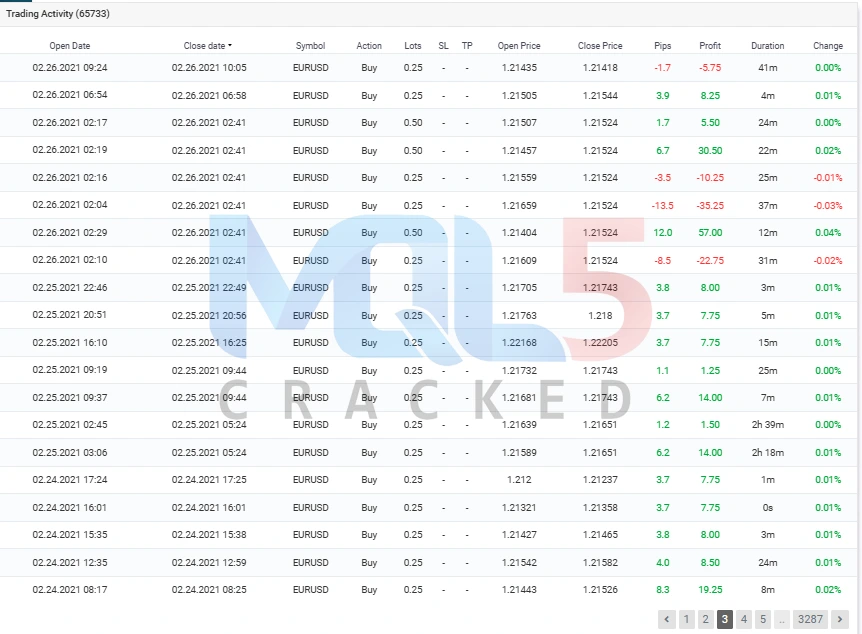

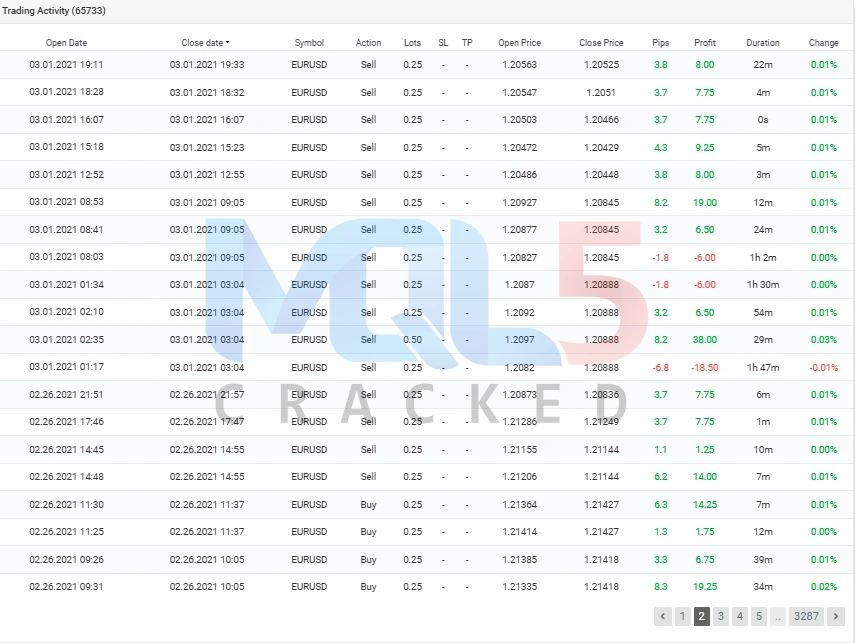

- Trades the EURUSD pair daily with high-frequency scalping

- Executes approximately 50–100 trades each week

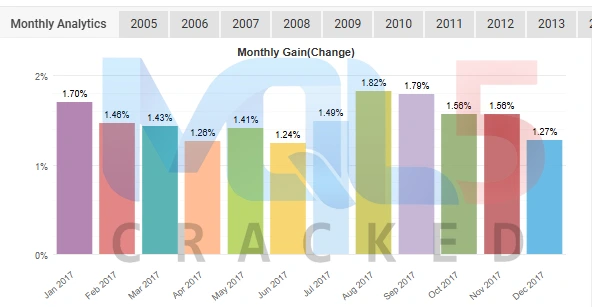

- Backtested with consistent profitability over the past 21 years

- Suggested starting capital: $5,000

- Works best with a 100:1 leverage ratio

- Traders can now replicate Vigorous-style trades on their own

- Features 71 adjustable input settings for personalized strategy control

Recommendations

- Compatible with MetaTrader 4 (MT4) platform

- Designed specifically for trading the EUR/USD currency pair

- Operates on the 1-minute (M1) chart for precise entry points

- Carries out 50 to 100 scalping trades weekly

- Expected monthly return ranges between 2% and 4% using default parameters

- The ideal starting balance is recommended at $5,000

- Best performance achieved with leverage of 1:100 or greater

BackTest Reports

MyFxBook Signal Reports

Reasons to use

Proven Long-Term Profitability: With over two decades of verified backtesting results, Vigorous EA has consistently delivered reliable performance on the EUR/USD pair, giving traders confidence in its strategy over varying market conditions.

High-Frequency Scalping Strategy: The EA is designed for active trading, executing 50 to 100 short-term trades each week on the M1 timeframe. This approach allows it to take advantage of minor price fluctuations, ideal for traders who prefer fast-paced strategies.

Steady Monthly Growth: By targeting a 2% to 4% return per month with default settings, it offers a sustainable profit model while maintaining conservative risk exposure, making it suitable for both seasoned and cautious investors.

Low Drawdown and Risk Control: Built-in safety features and an advanced risk management system help reduce potential losses, ensuring more stable equity curves and better protection of trading capital.

Customizable Settings: With 71 configurable input options, traders can tailor the system to their preferred risk levels, trading styles, and market conditions, adding flexibility for both manual and fully automated strategies.

Optimized for MetaTrader 4: The EA is fully compatible with the widely-used MT4 platform, offering seamless integration and real-time trade execution without the need for manual intervention.

Efficient Capital Usage: With a recommended starting balance of $5,000 and a leverage ratio of 1:100 or more, Vigorous EA provides a balanced setup for maximizing returns while managing exposure effectively.

Pros and Cons

✅ Pros of Vigorous EA

- Consistent Returns: Designed to generate stable monthly profits ranging from 2% to 4%, making it suitable for steady portfolio growth over time.

- Scalping Powerhouse: Executes between 50–100 trades per week, capitalizing on short-term movements in the EUR/USD market.

- Tested Over Time: Backed by over 21 years of historical data, proving its resilience across various market cycles.

- Low Drawdown Approach: Implements effective risk controls to protect capital and maintain low equity dips, giving traders peace of mind.

- Customizable Settings: Offers 71 adjustable parameters, allowing users to tweak the strategy based on market behavior or personal preference.

- User-Friendly on MT4: Built specifically for MetaTrader 4, making installation and execution smooth for both beginners and experienced traders.

❌ Cons of Vigorous EA

- Requires Initial Capital: A Recommended starting balance of $5,000 might be high for small account holders.

- Dependence on One Pair: Focused solely on EUR/USD, which limits exposure to other currency pairs and diversification.

- Scalping Strategy Needs Good Conditions: Performs best with low spreads and fast execution, so not all brokers may be suitable.

- Requires 1:100 Leverage: Optimal results depend on a specific leverage setting, which may not be ideal for very conservative traders or certain jurisdictions.

Reviews

Clear filtersThere are no reviews yet.