What is Eternal Engine EA?

Eternal Engine EA combines technical indicators with grid trading strategies for consistent performance in diverse market conditions. Its advanced logic identifies profitable trades while prioritizing effective risk management.

About Eternal Engine Author

Wei Tu is the developer of the Eternal Engine EA, and she has 3 years of experience.

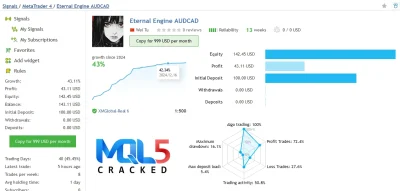

MQL5 Signal Reports

Growth:42.82%

Profit:42.82 USD

Equity:119.88 USD

Balance:142.82 USD

Initial Deposit:100.00 USD

Withdrawals:0.00 USD

Deposits:0.00 USD

Profit Trades: 75.8%

Loss Trades: 27.6%

Maximum drawdown: 16.1%

Max deposit load:5.4%

Growth:114.46%

Profit:271.13 USD

Equity:367.87 USD

Balance:371.24 USD

Initial Deposit:1 000.11 USD

Withdrawals:2 200.00 USD

Deposits:1 300.00 USD

Profit Trades: 75.8%

Loss Trades: 24.2%

Maximum drawdown: 26.9%

Max deposit load:21%

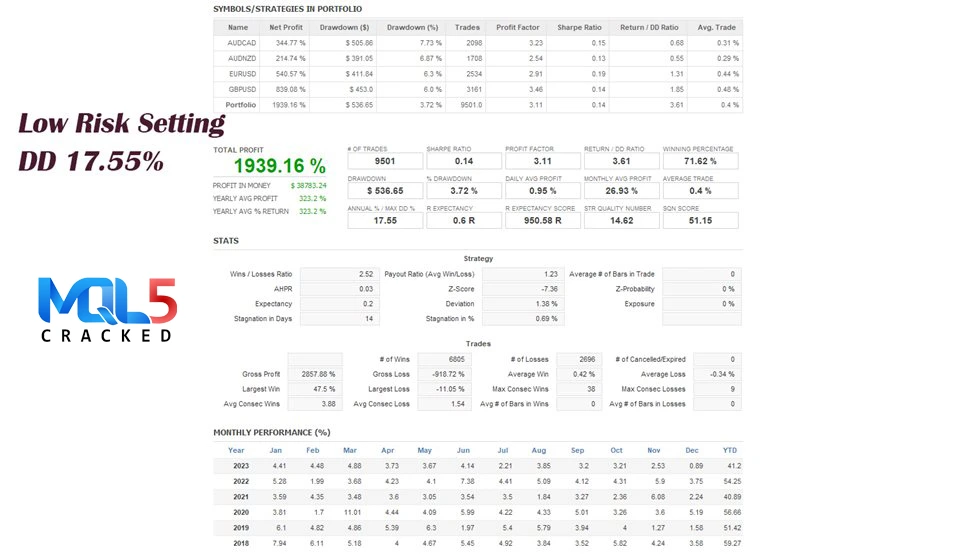

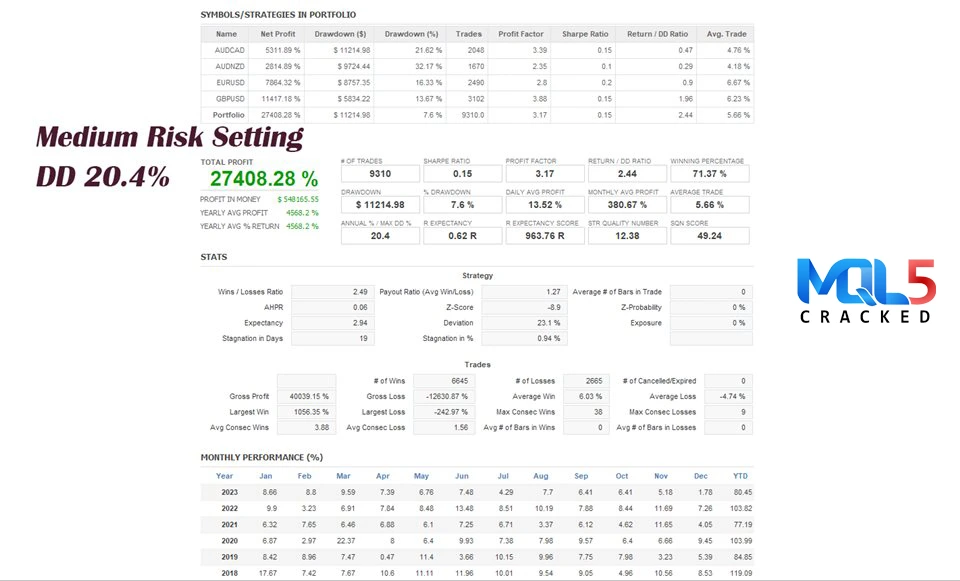

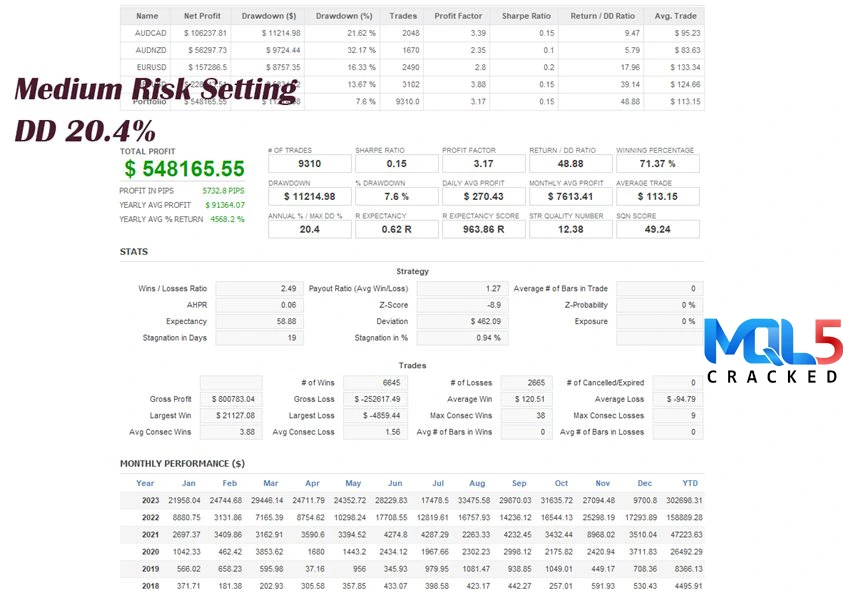

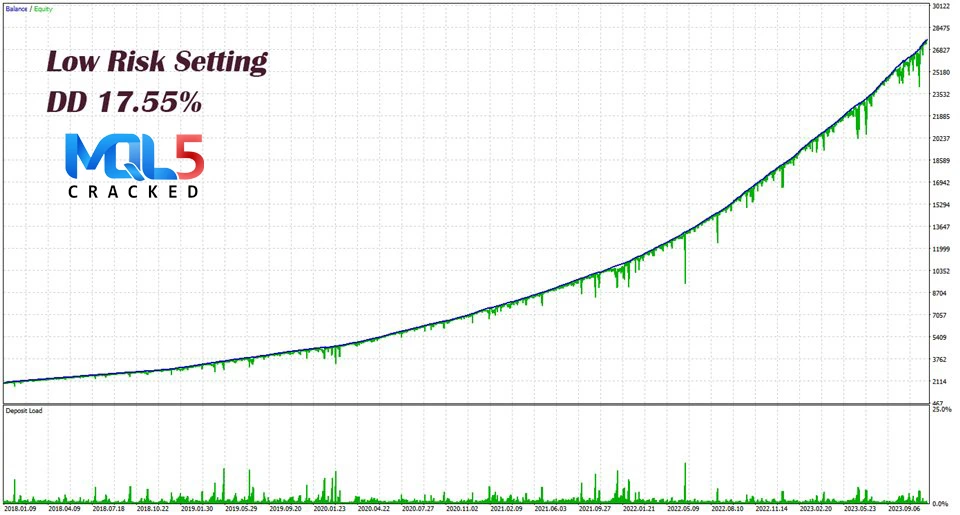

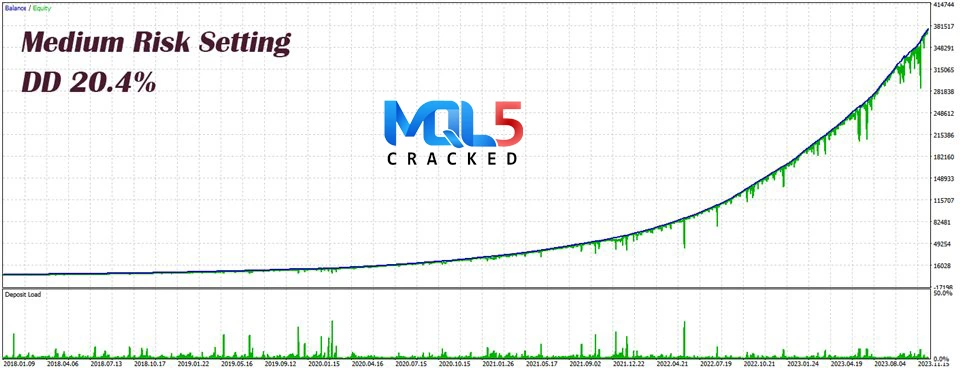

Strategy Tester Reports

Key Takeaways

Trade Signals: Generated using moving averages, trend lines, and support/resistance analysis.

Dynamic Strategy: Adapts to market momentum and detects reversals or breakouts in range-bound conditions.

Risk Control: Implements flexible stop-loss and take-profit settings for optimal trade management.

Setting / Features

- Supported Pairs: GBPUSD, EURUSD, AUDCAD, AUDNZD

- Timeframe: Works on any timeframe

- Trading Hours: Operates 24/7

- Customization: Adjustable grid distance, volume multiplier, and number of symbols traded simultaneously

- Risk Management: Flexible drawdown limits and multiple risk control options

- Platform Compatibility: Spread-insensitive, suitable for various brokers

- Capital Requirement: Ideal for accounts with small balances

Pros and cons

Pros

- Versatile Pair Support: Works well with multiple currency pairs like GBPUSD, EURUSD, AUDCAD, and AUDNZD.

- Timeframe Flexibility: Compatible with any timeframe for diverse trading strategies.

- 24/7 Trading: Operates continuously without manual intervention.

- Highly Customizable: Offers adjustable grid distance, volume multiplier, and trade symbol limits.

- Effective Risk Management: Multiple options to control risk and manage drawdowns.

- Spread-Insensitive: Performs reliably on different platforms, regardless of spreads.

- Small Capital Friendly: Suitable for traders with limited funds.

Cons

- Risk with Grid Strategy: Grid trading can lead to significant drawdowns in volatile markets.

- Martingale Component: The volume multiplier increases trade size, which can amplify losses in losing streaks.

- Customization Complexity: Beginners may find the numerous settings overwhelming to optimize.

- Limited Pair Diversity: Restricted to a specific set of currency pairs, reducing diversification.

- Requires Monitoring: Despite automation, occasional oversight may be needed to adjust for market changes.

Explore Other Profitable EAs

Get the Eternal Engine for free,

Yes, you can get the Eternal Engine for free on the MQL5Cracked website.

See the following pages to get the Eternal Engine for free

FAQ for the Eternal Engine

- What currency pairs does the EA support?

It works with GBPUSD, EURUSD, AUDCAD, and AUDNZD. - Which timeframes are recommended?

The EA is compatible with any timeframe. - Can it trade around the clock?

Yes, it operates 24/7. - Is it customizable?

Yes, you can adjust grid distance, volume multiplier, drawdown limits, and the number of symbols traded simultaneously. - Does it require a large investment?

No, it’s suitable for accounts with small capital. - Is it sensitive to spreads?

No, it performs well across various platforms, regardless of spread. - How does it manage risk?

It uses adaptive stop-loss and take-profit settings, along with other risk control options. - Can beginners use it?

Yes, though customizing settings might require some learning for optimal results. - Does it work on all brokers?

Yes, it is compatible with most brokers that support MetaTrader. - Is the strategy risky?

It uses grid and Martingale components, which can increase risk in volatile markets. Use proper risk management settings.

Reviews

Clear filtersThere are no reviews yet.